3 Artificial Intelligence (AI) Stocks to Buy Hand Over Fist in January

[ad_1]

The artificial intelligence (AI) market exploded in 2023 and shows no signs of slowing. The debut of ChatGPT reignited interest in the sector and forced many to rethink what they thought was currently possible with the technology. As a result, countless companies pivoted their businesses to developing the industry.

Data from Grand View Research shows the AI market is projected to expand at a compound annual growth rate of 37% through 2030. That would see it hit annual sales exceeding $1 trillion before the decade’s end. That makes now a great time to invest in this rapidly expanding industry and potentially profit from its promising outlook.

Here are three AI stocks you might want to consider buying hand over fist in January.

1. Advanced Micro Devices

Advanced Micro Devices (AMD -5.45%) has an exciting year ahead, with plans to strengthen its role in AI by launching a new chip. The company will begin shipping its MI300X graphics processing unit (GPU) in 2024, designed specifically to challenge Nvidia‘s dominance.

Nvidia soared to the top of the market in 2023, getting a headstart as it snapped up an estimated 90% market share in AI chips. Its success in the industry highlighted how far chipmakers like AMD are behind when it comes to AI.

However, AMD spent the last 12 months refining its AI technology and it’s hoping to make a big splash in the sector this year. As the cost of AI chips rises, the industry is desperate for increased competition and alternatives to Nvidia. Consequently, AMD’s MI300X has support from firms across tech, with Microsoft‘s Azure announcing in December that it will become the first cloud platform to use the new GPU to optimize its AI offerings.

Data by YCharts

The chart above shows AMD’s earnings could hit $5 per share by fiscal 2025. When that figure is multiplied by the company’s forward price-to-earnings ratio of 55, it gives a stock price of $275, suggesting growth of 87% over the next two fiscal years.

AMD is on a promising growth trajectory and could be one of the smartest investments this month.

2. Intel

Like AMD, Intel (INTC -4.15%) is hard at work designing a new AI chip to take on Nvidia in 2024. In December the company unveiled several new additions to its product lineup, including the Gaudi3, which is launching this year and is capable of powering demanding AI models.

Intel has transformed itself over the last few years. A long history of dominance in central processing units (CPUs) saw it grow complacent, leaving it vulnerable to competition. Its CPU market share fell from 82% to 61% between 2017 and 2023 as AMD strengthened its position in the industry. Then in 2020, Apple ended its partnership with Intel in favor of in-house hardware, taking a significant bite out of the chipmaker’s earnings.

However, instead of throwing in the towel, the hurdles seemed to light a fire under Intel again. The company unveiled its first consumer GPUs in October 2022, venturing into a new market that would see it go head-to-head with Nvidia and AMD. The move was a smart one in the run-up to the boom in AI, as GPU technology is crucial to its success in the industry over the long term.

Data by YCharts

Intel’s massive growth potential is evident in its EPS estimates. This chart shows its earnings are projected to reach nearly $3 per share over the next two fiscal years. In a similar calculation to AMD, multiplying the figure by Intel’s forward P/E of 53 yields a stock price of $140. If the estimates hold, the company’s shares would deliver growth of 180% by fiscal 2025.

As a result, Intel is absolutely an AI stock worth buying hand over fist this January.

3. Alphabet

Alphabet (GOOG -1.70%) (GOOGL -1.78%) enjoyed a glowing 2023. Its digital ad business made an impressive turnaround from the previous year, with revenue rising 11% year over year in its latest quarter (the third quarter of 2023) as it beat analysts’ expectations by $980 million.

Meanwhile, the tech giant has exciting prospects in AI. Alphabet’s highly anticipated large language model Gemini debuted in early December, and is capable of crunching various forms of data with more sophisticated reasoning than any of the company’s previous technology.

Gemini and Alphabet’s potent platforms, like Google Search and Android, could prove a powerful combination, presenting countless ways for the company to expand in AI. Alongside free cash flow that rose 29% over the last year to $77 billion, Alphabet has the financial resources and brand loyalty to go far in the industry.

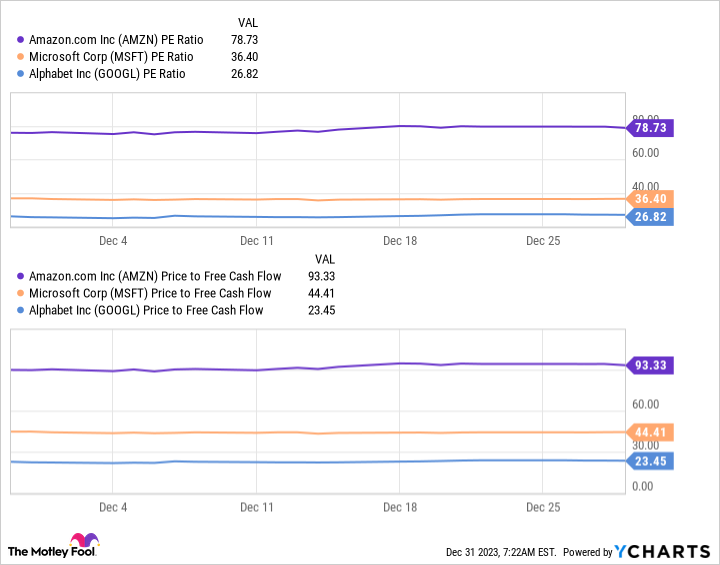

Data by YCharts

Alphabet’s biggest competitors in AI are cloud giants Amazon and Microsoft. However, Gemini and Alphabet’s massive user base suggests the company has equal, if not more, earnings potential in AI. Meanwhile, this chart shows Alphabet’s P/E and price-to-free cash flow are significantly lower than those of its rivals, making its stock a bargain compared to Amazon and Microsoft.

Alphabet likely has a bright future in AI and is a no-brainer investment this month.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

[ad_2]