IonQ Surged Over 290% in 2023, But Is It a Buy?

[ad_1]

Quantum-computing pioneer IonQ (IONQ 0.98%) soared in 2023. On the morning of December 27, the stock had gained a cool 299% year to date, outperforming every member of the S&P 500 (SNPINDEX: ^GSPC) index by a wide margin. Only a handful of hypervolatile stocks and jumpy cryptocurrencies outperformed IonQ this year.

So IonQ is on a roll, but where will the stock go from here? Is the rocket ride running out of quantum-powered fuel, or was this just the start of a soaring long-term trend?

Let’s have a look.

How IonQ got to the top of the mountain

IonQ is a pioneering company in the field of quantum computing, known for developing quantum computers that leverage trapped ions for quantum processing. Their approach aims to offer significant advantages in scalability and precision over traditional transistor-based computers, potentially revolutionizing areas like material science and drug discovery, and solving complex algorithms.

So far, access to IonQ’s most advanced quantum-computing systems is available through the leading cloud-computing platforms, though deep-pocketed customers certainly can pony up more than $12 million for a system of its own.

The company’s focus on advancing quantum technology positions it at the forefront of this cutting-edge scientific frontier with potentially game-changing business prospects in the long run. Quantum computing may disrupt high-powered computing, replacing today’s digital systems for tasks such as cryptography, data analysis, and machine learning.

So IonQ’s area of expertise dovetails nicely with some of the year’s most important megatrends, including artificial intelligence (AI) and data security. It’s no surprise to see the stock essentially soaring above the entire stock market on tailwinds like these.

A plethora of alternatives

Now, IonQ is an early mover and pioneering inventor but not the only name in the quantum game.

For example, Microsoft (MSFT 0.32%) Azure’s quantum-computing service offers cloud-based access to IonQ system next to four competitors. The rival solutions come from former Honeywell (HON 0.11%) subsidiary Quantinuum, the microcap upstart Rigetti Computing (RGTI 2.78%), privately held Yale offshoot Quantum Circuits, and the PASQAL group, founded and led by Nobel Prize laureate Dr. Alain Aspect.

The financial and academic firepower behind these alternatives is mind-boggling, and Azure’s roster isn’t even a complete list.

Microsoft may rely on third-party hardware specialists but the company is a leading developer of software and algorithms in the quantum-computing space. International Business Systems (IBM 0.29%) is also “bringing useful quantum computing to the world.” And Alphabet (GOOG 0.18%) (GOOGL 0.21%) supplements its systems from IonQ and others with its own quantum-hardware development.

IonQ’s early success may establish the company as a sustained leader in quantum-computing systems, but there’s no shortage of dedicated competition.

Be careful with this red-hot ticker

The quantum-computing industry is barely getting started. The million-dollar systems you buy today will probably turn into useless toys over the next few years as research and innovation turn the quantum space upside down a few times. It’s an exciting time for sure, but it’s also too early to say who the long-term winners may be.

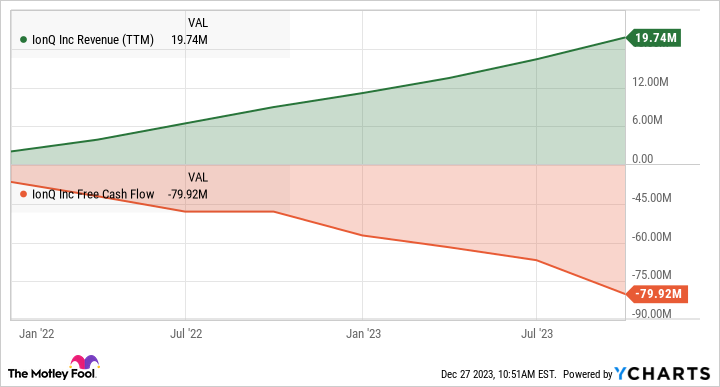

In the meantime, IonQ’s sales are surging, but the company also burns more and more cash over time:

IONQ Revenue (TTM) data by YCharts.

With a $2.7 billion market cap in a market with the potential for trillion-dollar sales by 2035, IonQ could certainly evolve into an industry giant over time. But the story could also play out in a million other ways, and many of the possible outcomes could put different hardware developers at the top.

It’s an exciting opportunity but also a risky one. A small position could make sense for this speculative stock, but I don’t recommend backing up the truck to IonQ’s stock while it’s trading at 138 times sales.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Alphabet and International Business Machines. The Motley Fool has positions in and recommends Alphabet and Microsoft. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.

[ad_2]