Sports Betting Is Now Legal in 38 States. These 3 Stocks Might Be Worth the Gamble.

[ad_1]

As an avid sports fan, I’ve been interested in sports betting for a while, even if it seemed reserved for Las Vegas trips and a few under-the-table sportsbooks. However, I think it’s safe to say that sports betting has become mainstream. All it takes is a couple of commercial breaks during a sports game to notice the recent increase in sports betting advertisements and platforms.

Much of sports betting’s recent surge in popularity can be credited to the U.S. Supreme Court’s decision to give states the autonomy to legalize and regulate sports betting on their own. When the Supreme Court made its decision, five states had legalized sports betting. Today, 38 states and Washington, D.C. have embraced legalized sports betting in some form.

For those looking to get in on the sports betting action from an investment standpoint, the following three stocks are worth considering.

1. DraftKings

DraftKings (DKNG -6.84%) is one of the earlier sports betting platforms and recently took over the top spot as the leader of online U.S. sports betting and iGaming (based on revenue).

After losing close to 85% of its value from March 2021 to December 2022, the stock has since treated its investors well. Part of this turnaround has been a result of additional states legalizing sports betting, and the other part is the company’s encouraging financials.

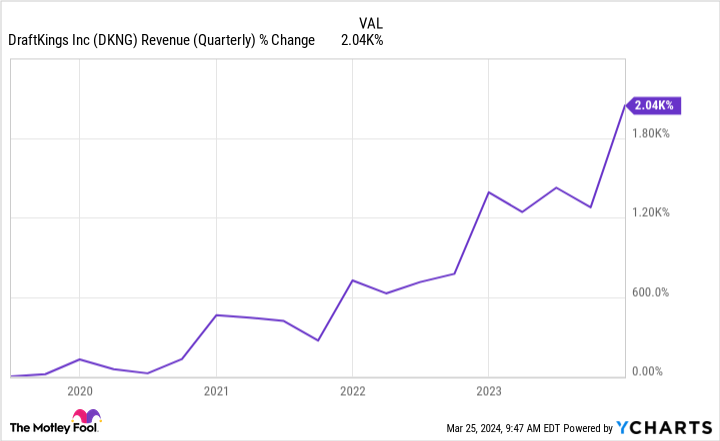

DraftKings’ focus is on growth and wining market share, so profitability has taken a back seat. Even so, profitability seems to be within striking distance. In 2023’s fourth quarter, the company made $1.23 billion in revenue, up 44% year over year, and its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) increased by $201 million to $151 million.

DKNG Revenue (Quarterly) data by YCharts

This positive trend should continue for DraftKings as its number of users continues to grow. At the end of 2023, it had 7.1 million unique customers, which was 1.1 million more than at the end of 2023’s first quarter. Its user base is growing fast and should help it maintain its market-leading position going forward.

2. Flutter Entertainment

Flutter Entertainment (FLTR 2.90%) is the parent company of the popular sports betting platform FanDuel. FanDuel was the leader in online U.S. sports betting and iGaming until DraftKings took over the spot last year.

Flutter Entertainment holds a leadership position in the U.K., Ireland, Australia, and Italy markets, giving the company a wide net to continue its growth. Still, it relies heavily on FanDuel to keep a stronghold in the U.S., where it became structurally profitable as of the end of the first half of 2023. (It reports bi-annually instead of quarterly like traditional U.S. companies.)

FanDuel, in particular, had an adjusted EBITDA of $100 million in the first half of 2023. A growing customer base should keep its financials on the right track, but an underrated catalyst for future growth is the company’s FanDuel Casino.

In the first half of 2023, FanDuel Casino’s average monthly players grew 52% year over year, and its revenue grew 48%. Being able to cast a wide net in sports betting and online casino markets allows Flutter Entertainment to leverage its diverse portfolio for greater market penetration.

3. The Walt Disney Company

Sports betting is likely not the first thing that comes to mind when you think of The Walt Disney Company (DIS 0.88%), but it’s the parent company of ESPN, which recently released its own platform, ESPN BET. Launched in November 2023, ESPN BET is currently only available in 18 states, leaving plenty of room for the company to expand its presence.

As more sports betting platforms begin to pop up, the market will definitely get a bit crowded, but ESPN BET has a competitive advantage that none of the other platforms can compete with: the financial backing of Walt Disney and the reach of the ESPN network. There’s a reason ESPN is called “The Worldwide Leader in Sports,” and you can bet (no pun intended) that the company will use its market position to its advantage.

Given how recently ESPN BET was released, there are no financials to measure it against, but if current ESPN success is any indication of what’s possible, the company’s choice to embrace sports betting should prove to be a good one. ESPN has been one of Walt Disney’s best assets for a while, and ESPN BET and the growing sports betting market should help boost this effort.

[ad_2]