You Might Be Surprised to Find Out What’s Driving Growth at Coca-Cola. Hint: It’s Not Coca-Cola

[ad_1]

Coca-Cola (KO -0.02%) the brand is synonymous with the red cans of its popular namesake beverage. The Coca-Cola name has incredible brand power, and it generates tons of cash to run the company and return some to shareholders. But there’s something else that’s driving higher growth now at the beverage giant — and that’s in the form of some of its other brands you might not know.

Isn’t it just Coke?

Coca-Cola owns 200 brands in several ready-to-drink categories. That’s actually trimmed down from about 400 before the pandemic. Management let go of about half its brands, mostly small, locally based brands that accounted for 2% of volume and only 1% of revenue. That was to free up resources to devote to its larger, core brands.

And it’s still developing and acquiring new brands. That’s important because it’s the newer brands that are contributing to higher growth overall. Coca-Cola has five categories: sparkling soft drinks; juice, value-added dairy, and plant-based; water, sports, coffee, and tea; energy; and hot beverages. It also has an emerging category.

The company doesn’t break out figures for how much each brand or category accounts for out of total sales, but it does provide growth rates. Although trademark Coca-Cola likely accounts for the bulk of total sales, it’s not the fastest-growing. In the 2023 fourth quarter, trademark Coca-Cola sales increased 2% over last year, but juice, value-added dairy, and plant-based beverages increased 6%. That performance was driven by Minute Maid brand Pulpy in China, Mazoe brand in Africa, and Fairlife dairy brand in the U.S.

This illustrates broader trends that management has identified.

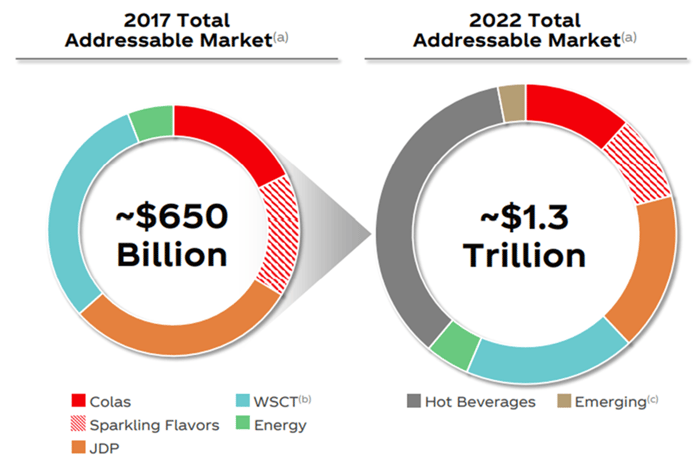

Image source: Coca-Cola.

Sparkling drinks, with Coca-Cola as the dominant brand, are shrinking as a portion of the overall non-alcoholic, ready-to-drink market. Even though the company got rid of underperforming brands, it’s crucial for it to invest in higher-growth brands that can generate higher sales, because these other categories present the most compelling growth opportunities. If this was the change from five years ago, it’s likely to keep moving in that direction.

Coca-Cola is still the brand to beat

Management puts a tremendous amount of investment into its trademark Coca-Cola drinks because they’re popular and people are willing to spend on them. Total revenue increased 6% in 2023, with a 2% increase in concentrate sales but a 10% increase in price/mix. Most likely, the price increase came predominantly from Coke’s core brands that have strong pricing power.

Management said that Coca-Cola became the 10th-most-valuable brand in the world in 2023, moving up seven spots from the year before, and Sprite was the top beverage brand for Gen Z drinkers. Building these brands with its customers boosts its pricing power for these drinks.

What do investors think?

Coca-Cola performed well in 2023 despite inflationary pressures. It has an incredible global distribution network, a strong marketing program that keeps its brands in customers’ minds, and pricing power that led to increased earnings per share. As it keeps up sales for its core brands, it generates large amounts of cash, with nearly $10 billion in free cash flow in 2023. That’s used to develop the new brands that will be the high-growth brands of the future.

That cash is also used to fund its storied dividend. Many investors find value in Coca-Cola stock because it’s a Dividend King, and its dividend yield is 3.1% at the current price. It’s an excellent operating model that should reward shareholders for decades.

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

[ad_2]