Canada Legalized Marijuana 5 Years Ago. Why Is the Industry Now in Such Bad Shape?

[ad_1]

On Oct. 17, it will be five years since Canada legalized recreational marijuana. The creation of a legal pot industry was supposed to provide cannabis companies with attractive growth opportunities. But it hasn’t worked out that way. Marijuana producers in Canada have struggled since legalization, and that’s putting it lightly. In fact, Canadian pot stocks have been some of the worst investments you could have owned over the past five years. During that time frame, shares of Tilray Brands (TLRY 4.93%), Canopy Growth, and Aurora Cannabis, which were once seen as the industry’s leading companies, have lost 99% of their value.

Why is the industry in such bad shape? And should investors expect things to get better?

The industry has gotten crowded

Today, there are close to 1,000 licensed cultivators, processors, and sellers in the Canadian pot market. As of the end of 2018, there were about 134 companies that were licensed under the Cannabis Act. The sheer growth during those years highlights just how many businesses have been rushing in to try and capitalize on the industry’s growth prospects.

That has made it incredibly difficult for large companies to gain a stable footing in the industry. Tilray Chief Executive Officer Irwin Simon once referred to these businesses as “ankle biters,” as they chipped away at its market share.

Back in 2021 when Simon was more optimistic about the company’s growth prospects, he was hoping his company could attain at least a 30% market share in Canada (at the time, Tilray had about 16%), which was part of his vision to get the business to $4 billion in annual revenue by 2024 — a forecast that management has since withdrawn. Today, Tilray boasts a leading market share in Canada of just 13.4%.With plenty of producers vying for market share, it looks doubtful the company will get anywhere near 30%.

Many Canadian marijuana companies have similar patterns in that they started fast out of the gate and were optimistic about the future, only to see things slow down considerably.

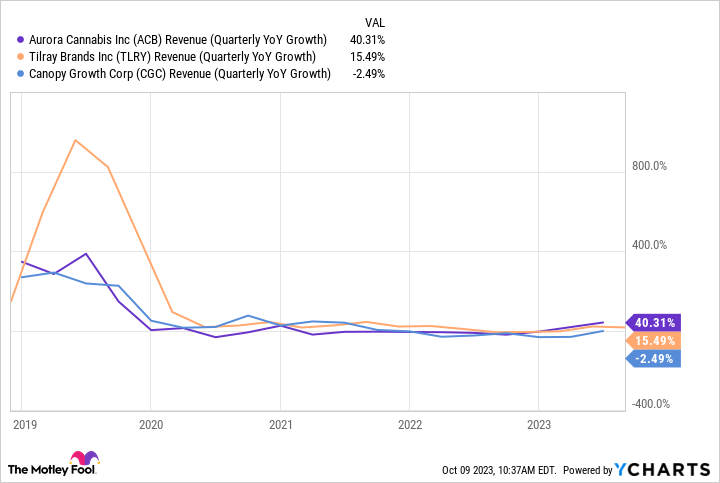

Data source: YCharts

Investors may be encouraged to see an uptick in revenue growth for Aurora and Tilray in recent periods. But it’s important to note that acquisitions have helped bolster some of these numbers, especially for Tilray, and that going up against weak comparable numbers from the previous year can make an increase in revenue appear misleading.

The black market still plays a big role

According to data from Canada’s Department of Public Safety, the black market still accounts for a third of the entire marijuana market. While that has been declining over the years, it presents a problem as black-market sellers often price products much lower than legal pot shops, with the discount being about 55%.

Because black market vendors don’t pay taxes, it makes it easy for them to undercut legal cannabis companies. One thing for investors to watch for is whether the situation deteriorates, especially if the economy weakens or goes into a recession and consumers struggle to afford legal pot products.

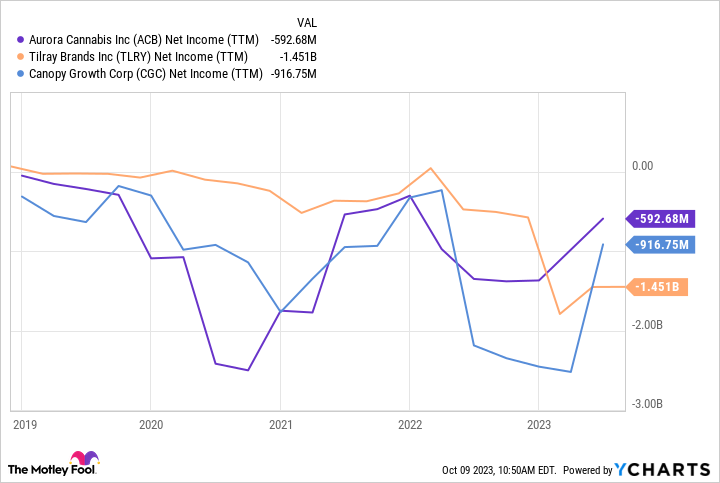

Pressure from not just many licensed producers but also the black market has effectively created a race to the bottom where cannabis companies need to price their products low in order to sell. And that isn’t a recipe for success, making it the norm for cannabis companies to be deeply unprofitable as the chart below shows.

Data source: YCharts

Should you take a chance on Canadian pot stocks?

There isn’t a reason to expect things to get better for Canadian marijuana companies. Competition remains fierce, and some companies are resorting to other options instead. Aurora has been focusing on medical marijuana and international markets. Canopy Growth has been selling properties to trim costs as it awaits the day when the U.S. legalizes marijuana (assuming that ever happens). Tilray, meanwhile, has been acquiring alcohol companies in an effort to diversify and be able to explore at least some growth opportunities in the U.S.

The Canadian pot market simply isn’t an attractive option for cannabis companies. But unfortunately, for many of these companies, there aren’t many good alternatives to seek growth, hence their poor results. Given the highly competitive landscape and little hope for a change anytime soon, investing in Canadian pot stocks remains extremely risky. These are not investments worth pursuing for the majority of investors. Investing in multi-state operators in the U.S. may be a better option, but that, too, comes with risks.

[ad_2]