Is It Too Late to Buy Berkshire Hathaway Stock?

[ad_1]

Warren Buffett’s holding company, Berkshire Hathaway (BRK.A 0.32%) (BRK.B 0.05%), has become one of the world’s largest companies. It currently trades just shy of a $1 trillion market cap.

Berkshire Hathaway holds a collection of private companies and stakes in public corporations, which Warren Buffett has bought stakes in over the years. As a whole, Berkshire has outrun the broader market, a testament to Buffett’s brilliance.

But is it too late for investors to buy stock in Berkshire today?

Here is what you need to know.

Berkshire is built for the long term

Understandably, Buffett’s age could be a concern for long-term investors. The investing great is in his 90s, and his right-hand partner, Charlie Munger, recently passed away. However, Buffett emphasized how the company is built to last in this year’s annual shareholder letter. The company’s holdings and financials certainly back up that thought.

Berkshire is made of several vital pillars — recession-proof businesses that generate steady profit streams for the company. Those include:

- Insurance underwriting

- Investment income from insurance float

- Railroads

- Utilities and energy

- Other businesses and miscellaneous items

Berkshire Hathaway’s earnings based on generally accepted accounting principles (GAAP) may fluctuate over time, but Buffett scores Berkshire on operating profits, which grew nearly $7 billion to $37.3 billion in 2023.

Suppose the United States fell into a depression or another economic “Black Swan” event — something nasty happened, Berkshire’s operating earnings turned negative, and the business started losing money.

In that case, Berkshire could lean on its balance sheet for stability. Buffett has kept a tremendous cash position for years, serving as a safety net and treasure chest for when an opportunity arises. Today, that cash pile is a staggering $167 billion, or more than four years of profits.

Admittedly, the day will eventually come when Buffett steps down for one reason or another. However, Buffett has already named his successor, Greg Abel. Knowing Buffett’s handpicked successor is on stand-by should give investors confidence that the company will maintain the financial culture that has made Berkshire so successful in the first place.

Is Berkshire priced right?

Valuing Berkshire Hathaway’s stock can be difficult because there are so many moving parts. Buffett doesn’t even worry about the company’s reported bottom-line profits, so consider looking at Berkshire’s book value instead. Today, Berkshire is trading near its all-time high, but the stock doesn’t look unreasonably expensive despite that.

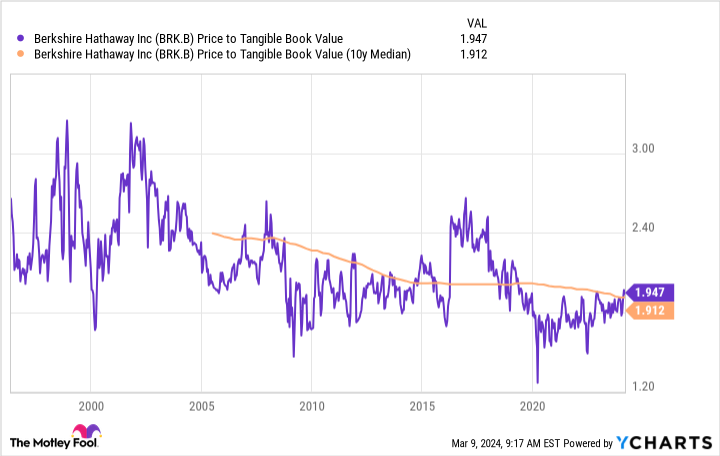

Berkshire’s price-to-book value ratio is on par with its rolling 10-year average:

BRK.B Price to Tangible Book Value data by YCharts

Wall Street generally assigned Berkshire a lower valuation over the past few years when interest rates were low, favoring high-growth stocks. That could be due to Berkshire’s conservative financial makeup. For example, Berkshire enjoys higher interest rates today because it can make 4% on its $167 billion cash pile via treasury bonds.

Here’s the bottom line

Berkshire is built for the long term, which means investors should also invest in the stock for the long term. Consider buying Berkshire stock a little at a time with the intent to hold for years, if not decades. Trust what Buffett has built to continue leveraging its massive size and deep pockets to steadily create value for shareholders.

After all, Berkshire’s investment success spans decades.

If the market crashes and the stock’s valuation plummets, as it occasionally has, use the opportunity to load up. Knowing what you’ve read above, you can feel confident that Berkshire has the financial staying power to endure economic pain, bounce back over time, and continue generating strong investment returns.

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

[ad_2]