Everyone Is Talking About This Stock. Is It a Good Long-Term Option?

[ad_1]

Nvidia (NVDA 2.13%) pulled off an impressive recovery this year after its shares plunged over 50% in 2022 alongside macroeconomic headwinds. The company’s stock skyrocketed 230% since Jan. 1 as it has become one of the biggest names in the budding artificial intelligence (AI) industry. Nvidia’s years of dominance in graphics processing units (GPUs) positioned it to profit immensely from the rise in AI as the chips became crucial to developing AI models.

Nvidia shares are popular this year as investors rushed to back to capitalize on its lucrative position in AI. Despite the spike in its stock price, the company remains an attractive investment for those in it for the long haul. Nvidia has a promising outlook in multiple areas of tech and could have a lot to offer patient stockholders.

Here’s why Nvidia remains a good long-term option despite its rapid growth this year.

Nvidia has a diverse business model with massive potential

Nvidia’s AI business has been front and center this year as it snapped a 90% market share in AI chips. However, the company is a lot more than AI, supplying its hardware to firms in multiple markets across tech.

Long before Nvidia hit it big in AI, the tech giant was best known for its success in gaming. The company attained an 87% market share in desktop GPUs primarily thanks to the popularity of its chips among PC gamers who use Nvidia’s hardware to power custom-built gaming machines.

The chipmaker’s gaming segment proved vulnerable to recent economic declines, with Nvidia’s gaming revenue falling 27% in its fiscal 2023 (ending January 2023). However, the business is gradually showing signs of recovery. In the second quarter of Nvidia’s fiscal 2024, gaming revenue was up 22% year over year.

Moreover, Nvidia is a leading chip supplier in the cloud market. Its list of prominent clients includes Amazon Web Services, Microsoft‘s Azure, and Alphabet‘s Google Cloud. The rise of AI has only further tipped the cloud market in Nvidia’s favor. Where central processing units (CPUs) once reigned supreme, the increase in demand for AI cloud services has seen GPUs become the most critical chip in cloud computing. A spike in GPU sales led Nvidia’s data center revenue to rise 171% year over year in Q2 2024, with total revenue up 101%.

Demand for chips will likely continue to rise over the long term as more markets seek powerful hardware to take their tech to the next level. As a result, Nvidia’s recent stock rise could be just the start of an exciting growth trajectory you won’t want to miss out on.

Prioritizing its AI expansion

Data from Grand View Research shows the AI market hit $137 billion in revenue in 2022 and is projected to expand at a compound annual rate of 37% through 2030. Meanwhile, Nvidia carved out a lucrative position in the industry as its go-to chip supplier. So, it’s no surprise that the company is continuing to prioritize its expansion in AI as it works to retain its spot at the top.

Nvidia’s AI business has been slightly threatened this year amid growing tensions between the U.S. and China, which led to increased sanctions on exporting high-powered chips. However, rather than lose out on one of the world’s biggest markets, Nvidia developed three new chips specially designed to help meet China’s rising demand for AI and comply with U.S. export controls.

China makes up about 20% of Nvidia’s revenue and has been a crucial market for Nvidia’s success in AI. In Q2 2024, Nvidia’s revenue from China rose 41% year over year as companies across the country heavily invested in AI. Consequently, the chipmaker is right to protect its business in the high-growth region.

Nvidia got a head start in AI, leaving chipmakers like Advanced Micro Devices and Intel playing catch-up this year. These competitors are gearing up to join the market next year and could threaten Nvidia’s leading position. However, Nvidia’s quick response to changes in Chinese exports bodes well for its future in the industry as it fortifies its long-term dominance.

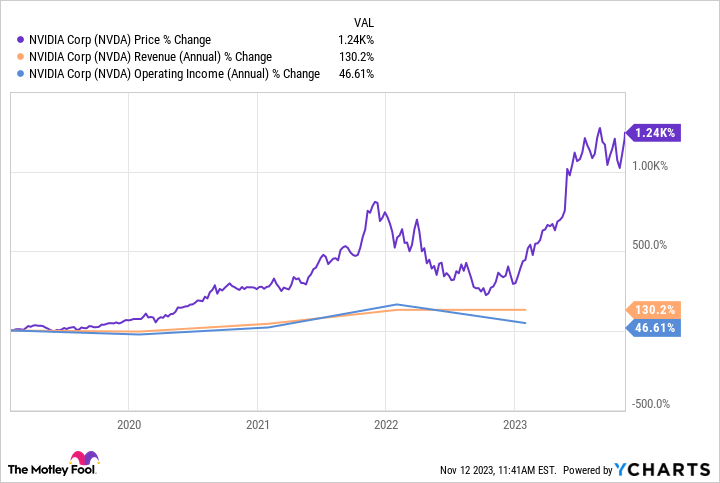

Data by YCharts

Nvidia’s stock skyrocketed over the last five years alongside soaring revenue and operating income. The company appears to be just getting started in AI. Meanwhile, its gaming and cloud businesses are on a promising growth path. Its business is on the rise, making Nvidia’s stock an excellent long-term option as it continues to profit from the development of the entire tech market.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.

[ad_2]