Is Nu Stock a Buy?

[ad_1]

Nu Holdings (NU 1.68%), the parent company of NuBank, is a rapidly growing company leveraging financial technology (fintech) to bring banking to underserved regions and completely dominates the Brazilian market.

Investors may be familiar with Nu Holdings as one of the 49 stocks in Berkshire Hathaway‘s publicly traded stock portfolio. Nu has achieved impressive growth and looks to replicate its success in other parts of Latin America. Here’s what you should know about this fast-growing bank and whether it’s a good fit for your portfolio today.

Nu brings banking to underserved communities

Nu founder David Velez was born in Colombia, raised in Costa Rica, and eventually attended Stanford, where he earned an engineering degree. After school, Velez gained valuable experience working for Morgan Stanley, General Atlantic, and Sequoia Capital.

When Velez returned to South America, he observed a broken banking system in Brazil, where five major banks controlled 80% of the market. These banks operated as an oligopoly, charging consumers exorbitant fees and leaving many in the country unbanked.

Velez looked to change this when he founded NuBank. His mission was simple: offer banking services to the Brazilian population using a digital platform. Without physical branch locations, NuBank could provide banking to customers with low or no fees, a drastic difference from what they were used to.

Image source: Getty Images.

The bank has achieved impressive growth and penetration of the Brazil market

Nu’s approach to banking in the underbanked region of Brazil likely attracted the attention of Berkshire Hathaway Chief Executive Officer Warren Buffett or, even more likely, Buffett’s two investment managers, Todd Combs and Ted Weschler. Berkshire added more than 107 million shares of the fintech in the fourth quarter of 2021, which it continues to hold today.

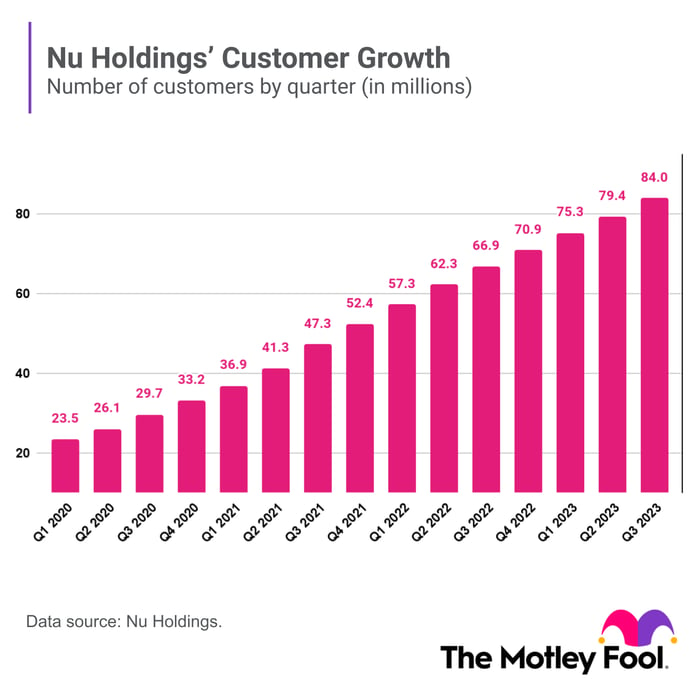

It’s been an up-and-down ride for shareholders, but the investment is beginning to show promise. At the end of 2020, the bank had about 33 million customers. By the end of the third quarter, it had more than 84 million customers and served over half of Brazil’s adult population. During that same period, the bank’s total payment volume jumped from $7.6 billion to more than $29 billion, a 282% increase in less than three years.

Chart by author.

Not only that, but Nu has done a good job of cross-selling and upselling products to existing customers. In the third quarter, its average revenue per active customer grew 18%, and its net profit of $303 million marked the bank’s third consecutive profitable quarter.

Investing in Nu isn’t without risks. The company faces risks from rising defaults if Brazil enters an economic downturn.

In the third quarter, about 6.1% of its loans were non-performing by 90 days or more, up from 4.7% the year before. Management pointed out the increase was expected and compares well to peers, but this is still something investors will want to keep an eye on in the coming quarters.

Is Nu Holdings a buy?

Nu stock is priced at around 8.7 times sales and 27 times forward earnings. This is a high valuation for a bank stock; however, it reflects the impressive growth of a bank in an underserved region of the world.

In less than three years, the bank added 4.3 million customers in Mexico and another 800,000 in Colombia. By expanding into Mexico and Colombia, Nu is tapping into the second- and third-largest consumer markets in Latin America, where about half of the population is unbanked.

Nu is a fast-growing bank worth a look from investors. The bank has done a stellar job of saturating the Brazilian market, and with about 70% of Latin America’s 650 million adults unbanked or underbanked, Nu has excellent upside potential and is a solid stock to buy today.

Courtney Carlsen has positions in Morgan Stanley. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends Nu. The Motley Fool has a disclosure policy.

[ad_2]