Best Stock to Buy Right Now: Spotify vs. Sirius XM

[ad_1]

Once upon a time, Sirius XM (SIRI -3.39%) was the elder statesman of digital radio services while Spotify (SPOT 2.86%) played the hungry upstart. As time went by, their roles changed. Now, Spotify has a $50.6 billion market cap and $13.3 billion in annual sales. In the opposite corner, Sirius XM weighs in at $17 billion and $9 billion on the same metrics.

Spotify’s fortunes have soared while Sirius XM’s starlight faded out. But past performance is no guarantee of future results, and the picture in the rear-view mirror never tells the whole story.

So where are these digital media pioneers going from here? Should investors pick up some shares in Sirius XM, Spotify, or both — or, just maybe, neither one?

Let’s find out.

Battle of the audio giants

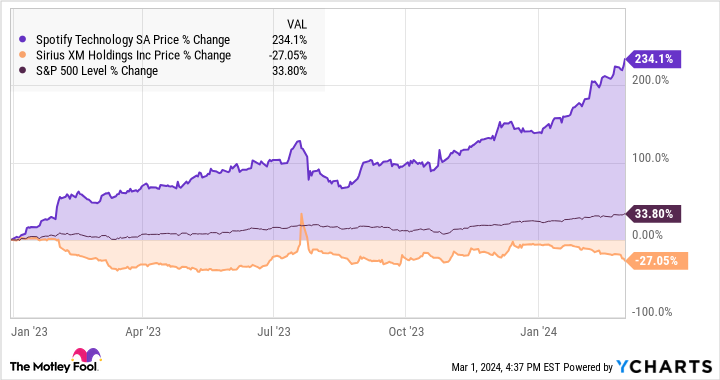

First, these companies have been headed in opposite directions lately. Spotify’s stock has posted strong gains since hitting rock bottom at the end of 2022, while Sirius XM’s chart trended downward amid the broad market recovery of 2023:

SPOT data by YCharts

So Spotify’s stock is soaring and the satellite radio veteran’s is falling. But this isn’t a completely random walk down Wall Street. These chart lines make sense when you consider how the two businesses are performing.

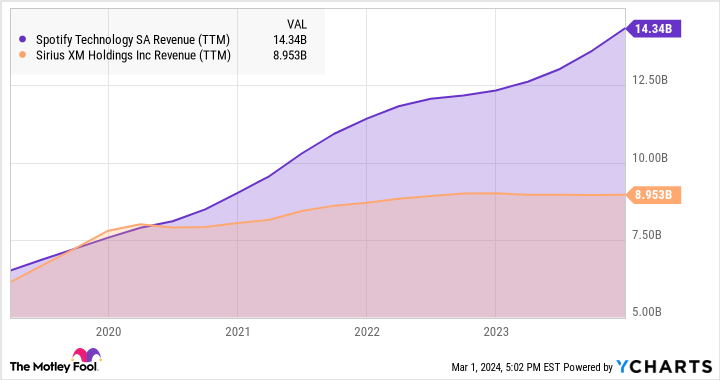

Spotify’s annual sales have increased by 16% over the same period. Sirus XM’s revenue is almost exactly flat. If you stretch that timeline to five years or more, you’ll see that Spotify keeps boosting its top-line revenue over time while Sirius XM’s growth mainly relies on buyouts. The Pandora acquisition in 2019 created a significant bump in Sirius XM’s sales chart. Smaller deals like the Stitcher podcast app or Conan O’Brien’s podcast network were too small to move the company’s financial needle.

SPOT Revenue (TTM) data by YCharts

Show me the profits!

Spotify is winning this race so far. I would much rather own a fast-growing service than a stagnant revenue stream.

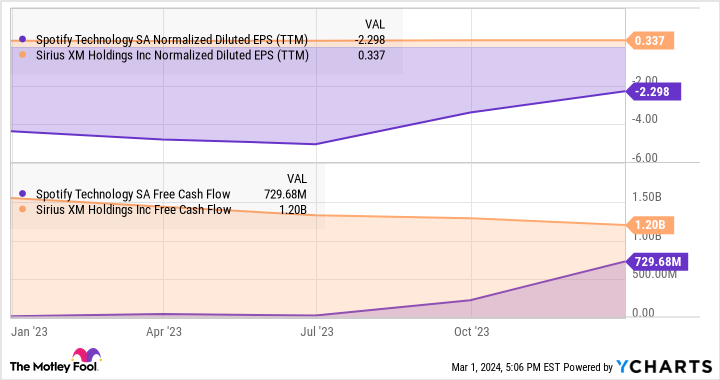

But what about profits? Isn’t Sirius far more profitable than Spotify?

Well, it used to be. But the profitability gap is shrinking quickly, whether you’re looking at bottom-line earnings or free cash flow.

SPOT Normalized Diluted EPS (TTM) data by YCharts

And the winner is Spotify

Spotify isn’t making profound changes to its business model or product portfolio. The existing plan works just fine, generating impressive user growth and revenue gains along with robust cash profits.

It’s hard to complain about 602 million monthly active users (MAUs), including 236 million subscribers to the premium plan, especially when both figures are growing by double-digit percentages year over year. The standard operating procedure of chasing audio content sources and running ambitious marketing campaigns will do just fine for the foreseeable future.

Sirius XM would love to do the same thing, but that’s not good enough. The company relies heavily on car sales, since new cars with preinstalled satellite radio systems serve as an important sales channel. But that industry has faced many challenges since the COVID-19 pandemic started. And Spotify is invading what’s left of this useful but clumsy growth market: Many automakers include Spotify apps on their infotainment system dashboards these days, but it’s also easy enough to connect your smartphone’s Spotify app to the speakers.

So Sirius is making content deals, hoping to build a game-changing portfolio of can’t-miss podcasts and curated music channels. It also revamped its smartphone apps last year, aiming for a more intuitive interface with user-friendly recommendation functions.

But the company is grasping at straws. Wading through Spotify’s and Sirius XM’s financial trends and fundamental business operations, I’m not finding many reasons to recommend the satellite radio specialist. None at all, really. The company needs another Hail Mary effort, comparable or superior to the Pandora deal, in order to stay relevant in this fast-changing media market.

Spotify walks home with a trophy this time. If you’re looking for a solid investment idea in the digital audio space, I would suggest accepting Spotify’s premium share price to grab a few stubs, because the stock is rising for good reasons.

Anders Bylund has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Spotify Technology. The Motley Fool has a disclosure policy.

[ad_2]